Post

Congratulations Blend! (NYSE: BLND)

By: Christian Lawless

Congratulations to Nima Ghamsari, Eugene Marinelli, Erin Collard and the entire Blend team on today’s incredible milestone.

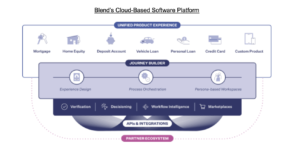

Blend’s mission is to create seamless customer experiences from application to close, making the process of getting a loan simpler, faster, and safer. Ultimately, the vision is to power one-tap access to all of the world’s financial resources.

We believe the hardest problems take time to solve and require patient capital, but subsequently create the greatest potential for economic impact. Oftentimes, entrepreneurs tackling these problems have qualities which align with long-term decision making that is critical for success. When talented teams of high integrity dedicate their lives to solving a hard problem, there is a good chance you should invest in them if given the opportunity. As venture capitalists, we are blessed with the opportunity to do this for a living.

Founded in 2012 by Nima Ghamsari, Eugene Marinelli, Rosco Hill, and Erin Collard, Blend foresaw a world without the complexities of the mortgage process, and wanted to bring the experience of getting a loan into the digital age. Conversion Capital was fortunate enough to be one of the first investors back in 2013, and subsequently participated in every financing round through to IPO today.

WHY NOW, WHY BLEND

The American economy, while the largest in the world, has many segments built on closed loop systems, spawning vendor lock-in and innovation stagnation. These inefficiencies have created enormous opportunities for startups seeking to replace outdated systems with poor customer experiences and to unlock seamless data integration.

One of the most fundamental segments of the US economy is the residential mortgage market, which has over $14 trillion of outstanding debt. This market is itself built atop a robust credit market, which allows consumers to tap into the value of their home and unlock upward mobility. Over 65% of homes in the United States are owner occupied and provide a substantial portion of household wealth. Not to mention, residential real estate construction creates employment opportunities for thousands of people.

The problem with this market, exposed in dramatic fashion following the 2008 financial crisis, was that most of the information held by mortgage stakeholders was kept in disparate silos, resulting in poor information transparency. Not only did the housing market collapse due to exorbitant leverage in the system, but the players involved were unable to see the true exposure to this asset class due to flawed technology architecture.

TIME FOR CHANGE

Until 2013, the mortgage market had a large set of entrenched players building atop these closed loop systems. This inevitably locked customers and counterparties into archaic technologies and processes, resulting in problems similar to those caused by monopolies. As a result, innovation stalled and ecosystems became inefficient. We see similar consequences today across critical infrastructure including systems in government, healthcare, logistics, and not least financial services, which are stunting National progress.

DIFFERENTIATED PLAYBOOK

Cloud computing, one of the most influential innovations of our time, has had a well-documented impact breaking up these closed loop systems. The transition from Sybase servers on Unix boxes to node js, APIs, and open-source software has unlocked immense and meaningful value creation. The impact of early cloud deployments revolutionized analogous sectors, and it was only a matter of time until industries like financial services would evolve as well.

But solutions to the problems plaguing the residential real estate market would not come from within the industry. Instead, it would require an engineering team with a different set of skills, leveraging step function changes in technology, and a new vision for the future. At the core of our best investments is a little-known theme – the greater the conceptual difference from the problem, the more novel the solution.

In our early days we were looking for seed stage fintech companies which fit our thesis (fintech = software, cloud, data) and were introduced to the team at Blend through a relationship at Palantir, where the founding team had previously worked to solve critical mortgage problems during the financial crisis of 2008.

Betting on a team, none of which had ever had a mortgage, to build a mortgage tech company may have seemed like a risk. In 2012, there weren’t many fintech companies to pick from, and even fewer mortgage companies. But we invest at the earliest stages of a company’s life, where it is less about the idea, and more about the people. It took a certain amount of naivete to tackle this problem, but also exceptional talent and creativity.

The first dozen meetings we arranged for Blend ended with the same dejected refrain. “Mortgage technology won’t change. It’s been the same forever. Microsoft tried to build better systems for the sector, but it didn’t work”. But as more doors closed, it was clear this opportunity was even bigger than we initially imagined.

ALL THE PIECES

Life can seemingly boil down to shared experiences and the learnings that come from them. Lessons picked up during deployments with Palantir shaped Blend’s decade-long development of an application layer for financial services to clean up the integration and adoption of consumer data.

Early technology adoption was once a herculean effort during the early days of Cloud 1.0, which required providers to ship data storage on prem to deploy with integration partners. Blend now deploys to over 300 customers, over 2,200 ecosystem partners, and has processed over $1.5T in loan volume annually. Cloud 2.0 is upon us, and the same customers which required onsite data integrations are fully deployed in the cloud. This has only accelerated the adoption of products from Blend and will continue to usher in a new generation of companies looking to deploy a similar playbook across the stack. It is clear that the industry has changed forever.

As we celebrate the IPO of Blend today (NYSE:BLND), the most important is the impact and opportunity which this company has created within financial services. The team has unlocked mortgage innovation and the industry is all the better for it.

EQUILIBRIUM

We launched Conversion Capital in 2012 with the underlying thesis that financial services infrastructure would inevitably become unbundled. Specifically, companies would move critical operating infrastructure to the cloud, transforming the industry in the process by unlocking access and product innovation.

Conversion Capital mortgage investments, including Qualia (title insurance), Figure (lending & blockchain), Polly (pricing and execution), Vesta (LOS), and Haven (servicing) are all growing quickly, and represent the continued unbundling of the mortgage stack. These changes happened slowly then suddenly, and we are now witnessing an unprecedented acceleration and complete overhaul in other verticals including payments, insurance, wealth management, banking, compliance, and blockchain.

We couldn’t be prouder of what the team at Blend has created, and the legacy their innovations will leave behind. The industry will never be the same again, and that’s a good thing.