Post

The Republic of Big Tech Pt. 2

Conversion Insights

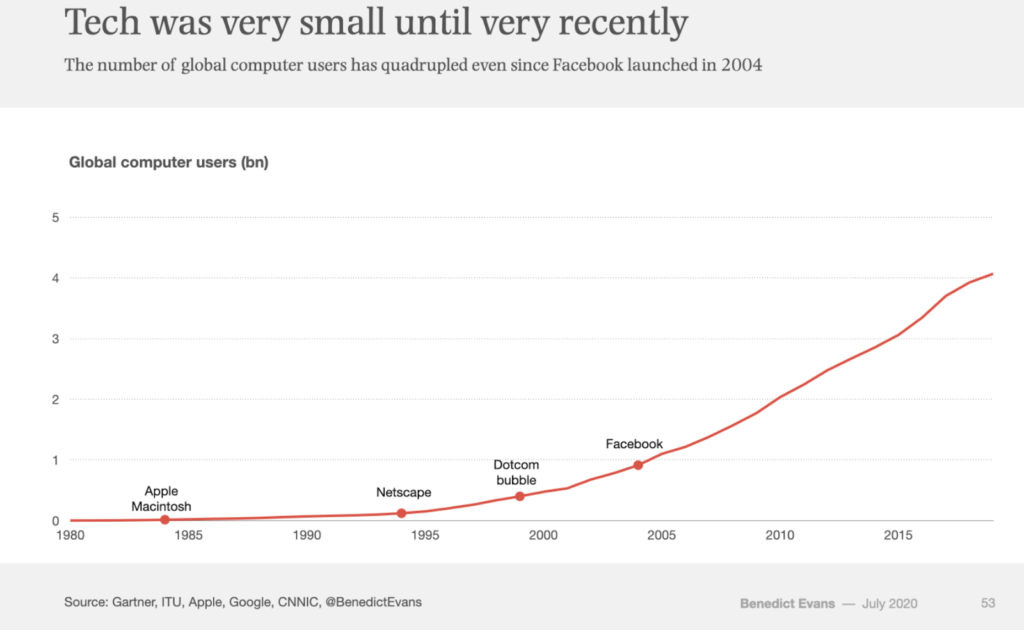

In our last installment, we addressed the monumental rise of the new economy, Big Technology firms that are gradually swallowing the cities they inhabit and now, the nation-states they occupy – Amazon to Amazonia. But what is left unclear is how regulators will address this change. After all, the US government et al. cannot open the floodgates of such corporate power publicly, especially not their sworn West Coast enemies who operate largely unchecked.

But one cannot help but think of Balzac’s infamous quip, “behind every great fortune lies a great crime.” When the global financial crisis occurred, the problems were unmistakably obvious – a highly leveraged and fragile financial system, where its agents were playing fast and loose with the rules. To avoid another apocalyptic scenario, regulators conjured the Dodd-Frank Act and Basel Accords to prevent such a situation from ever happening again. The Maginot line between the financial system, governments, and institutions was laid bare for all to see, so that we could take clear and decisive action. However, that story is different to a world where technology is the driving force of change. Every societal benefit and problem is now, first and foremost, driven by technology.

So, how would we regulate these firms – does it make sense to spend the time and resources to wage war against FAANG? Answering this requires us to travel to the dawn of antitrust. In the late 1800s, corporate monopolies, or trusts as they would bring, became pervasive in America as the culmination of the Civil War opened the door for businesses to integrate vertically and horizontally across industries like oil, steel, and manufacturing. The founders of such corporations – Rockefeller, Carnegie, and Vanderbilt – were both lionized and despised; society at the time was awe-struck at their sheer glamour and excess, but they could understand the tectonic shifts that such power had engineered. America could never again return to the premodern world: the new kings, and scapegoats, were now the industrialists.

After swallowing or merging with their competition, these trusts often engaged in what we now consider to be nefarious business practices like price-fixing and controlling production volume to maximize profits. To counteract this, the Sherman Antitrust Act of 1890 permitted the federal government to prohibit trusts; despite its loose construction at the start, failing to define words like “trust” or “conspiracy,” future presidents iterated on the fundamental ideals of the Act and were able to use it for great effect. Hence, during the Progressive Era, William Taft broke up Standard Oil in rapid succession, leading to a new era of big business and the Seven Sisters (e.g. Exxon, Mobil, Chevron). The company could easily be split into separate parts; it was easy to understand how an oil company worked.

And later in the century, the same approach was used to tackle AT&T. Upon its separation, the parent company of AT&T provided long-distance service while the seven “Baby Bell” companies orchestrated local service – many of the Baby Bells later merged. But in the Internet era, this strategy hasn’t taken off. Microsoft, though it lost its lawsuit, overturned its dissolution through a court-ordered appeal in 2001. Then, in 2019, the government – the DOJ and FTC – began its chase once again; they began to look for evidence of malicious anti-competitive practices espoused by Google and Facebook. But even if the Justice Department were to, say, breakup Google’s ad business – what does that mean and does it resolve the dormant issues that caused this trouble in the first place?

Ben Evans lays the case that “when software becomes part of society, all of society’s problems get expressed in software. We connected everyone, so we connected the bad people, and more importantly we connected all of our own worst instincts.” When people complain about technology, they are really criticizing other users who use these platforms in ways that they don’t like.

Technology may not be the core impetus for all of society’s woes, but it’s true that it’s the low-hanging fruit. Politicians mistakenly believe that breaking up Facebook et al. will level the playing field. In reality, it might be akin to what the West did with emerging markets like those in Africa: disturb their industrializing process (ie. shutter coal-fired plants), so that they cannot transform into formidable competitors for western firms.

The hotly debated question, of course, is not whether governments can break up Big Tech, but whether or not they should. Historically, anti-monopolistic rules rely on market share (the HHI index) and by that standard, Amazon looks positively delightful as it owns about 6% of US retail. Naysayers of the tech giant will say that Amazon controls over 50% of e-commerce traffic. In the digital age, what metric defines a company’s success? Is Amazon’s control of e-commerce traffic more important than the fact that consumers love the company?

Let’s take the example of Elizabeth Warren, who rose to political stardom for voicing her concerns about Big Tech, and who acts as a useful case study in understanding how politicians think about technology. Despite what users proclaim, she says that these giants have too much power today (read: they’re stronger than the federal government), so that, for the sake of societal welfare, the US government’s hand is forced – these monopolies must go. While her intentions may have been moral (higher Facebook usage is correlated to depression after all), one has to ask about her plans for regulation and, more importantly, why the tech industry itself?

Technology isn’t the only area subject to the predatory behaviour she suggests, but there is no discussion around busting up monopolies that cause devastating harm like those in the energy industry; Pacific Gas and Electric, for instance, has caused 117 deaths due to its negligence since 2010. Or, in an era where free speech is an endangered species, willfully choosing not to go after the six major corporations that define the modern media apparatus: Walt Disney (DIS), Time Warner (TWX), ViacomCBS, NBC Universal, and News Corporation (NWSA). Arguably, these constitute the Standard Oil of our era.

When addressing Google, she opines: “Google’s ad exchange and businesses on the exchange would be split apart. Google Search would have to be spun off as well.” How and why would Google’s ad exchange and search be broken apart? As the driving revenue generator for Google, advertisements are a key part of the search company’s business that they themselves pioneered. Furthermore, she makes the case that, as president, she would aim to divorce Zappos and Whole Foods from Amazon and WhatsApp and Instagram from Facebook.

Under the guise of “healthy competition,” Warren and other trust breakers are performing a lobotomy blindfolded. If they really aim to deliver a just reprisal to these companies, how can they do so with precision? The clear threat of an antitrust lawsuit is often a sign that a company has peaked. Microsoft had its stagnant years during the 2000s as newcomers, particularly web-based companies, stormed onto the scene; Bill Gates ostensibly attributes this lackluster performance as a result of his absolute focus on the antitrust case.

Surely, a lawsuit impairs a company’s decision-making and therefore, governments don’t have to break trusts all the way. In truth, regulation itself might be myopic – the length of a company’s tenure in the S&P 500 is the lowest in history. “99% of startups die of suicide, not murder,” as the notable Y Combinator saying proclaims. But the same is true of large companies. Ex ante, bureaucracy and short-termism are the causes for the decline and fall of generational corporations – American business lore is littered with examples like Kodak and Nokia who were too stubborn to see the obvious writing on the wall. Their demise was foretold years before they became irrelevant.

Rather than accept destiny, startup founders should focus on the gaps left behind by technology incumbents. How can they succeed despite the Republic of Big Technology’s iron fist? Fundamentally, startups have to focus hidden areas, rare secrets, and carve out their niche. Indeed, Google owns the majority of the world’s machine learning talent; yet, technology has always been about doing more with less. Even with regulation, startups would have to find hitherto unknown ways to compete for talent. Many companies have not yet figured that the future will look very different from the past; building for a pre-covid world is not an astute selling point. Founders should note that chaos is a precursor to massive organizational restructuring, as it happened with Airbnb and Stripe after 2008, turning the twin worlds of realestate and finance on their heads.

Similarly, venture capital is absolutely going through a major inflection point; Marc Andreessen has speculated that venture funds will split off into two branches: mom and pop stores (highly niche capital) and Walmart (huge funds like a16z). Money won’t be created equal – brand power and specialized capital are the future of investment management. And the future of software is in connecting niche pieces together, so this actually helps startups. Companies don’t need an enormous number of employees to make a huge impact. By the time of their sale, WhatsApp had 55 employees while Instagram merely had 12.

One could do worse than to remember Machiavelli’s incisive commentary on revolutions: “I’m not interested in preserving the status quo; I want to overthrow it.” Competing against the tech incumbents may be insurmountably difficult, but irrespective of regulatory prowess, there are plenty of ways for startup founders and investors to flourish in this environment. The macroeconomic circumstances are certainly out of one’s control – the road out of the dark forest is opaque to anyone embarking on this daring journey of building a masterful company. And, paradoxically, if all eyes are on the tech giants, very few are paying attention to the dramatic shift in entrepreneurial tailwinds and those who seek to rebuild the entire system.